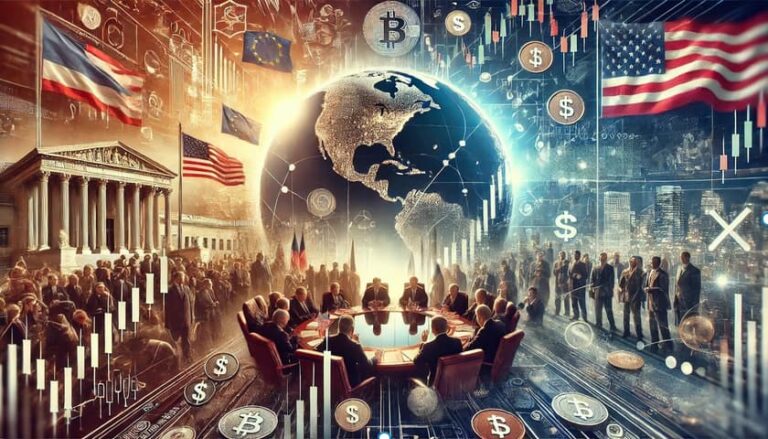

Political events play a significant role in shaping the direction of global financial markets. Elections, government policies, and geopolitical tensions create an environment of uncertainty, which can lead to fluctuations in market prices and investor sentiment. For instance, during national elections, the possibility of new leadership or policies can lead to market volatility, as investors react to potential changes in economic strategy or regulatory approaches. Similarly, geopolitical events such as wars, trade disputes, or international sanctions can disrupt the supply chain, influence commodity prices, and affect currencies. Traders and investors often adjust their strategies based on the expected outcomes of these events, with risk management becoming crucial in times of political upheaval.

One example of this dynamic can be observed in the way traders rely on platforms like the Exness broker to navigate volatile market conditions caused by political changes. With access to real-time data and advanced trading tools, traders can make informed decisions based on political risk assessments, adjusting their portfolios to protect against potential losses. By staying updated on political events, traders can take advantage of opportunities in the market or hedge against political risk through the use of derivatives, such as options or futures contracts. As political events continue to shape global markets, understanding their potential impact has become an essential part of successful trading strategies.

Understanding Financial Markets and Trading

Financial markets are platforms or systems where buyers and sellers trade financial assets, such as stocks, bonds, commodities, and currencies. These markets play a crucial role in the global economy by facilitating the flow of capital and helping allocate resources efficiently. There are different types of financial markets, including stock markets, where companies issue shares to raise capital; bond markets, where governments and corporations borrow money by issuing debt; and commodity markets, where goods like oil, gold, and agricultural products are bought and sold. Additionally, the foreign exchange market (forex) facilitates the exchange of currencies between countries.

Trading, on the other hand, involves the buying and selling of these financial instruments with the aim of making a profit. Traders, who may be individuals, institutions, or professional brokers, seek to capitalize on price fluctuations in financial assets. There are various approaches to trading, including short-term trading (such as day trading), long-term investing, and algorithmic trading, which uses computer programs to execute trades. The success of trading depends on analyzing market trends, understanding the forces that drive prices, and managing risk. Factors such as economic data, corporate earnings, geopolitical events, and investor sentiment all influence market prices, making financial markets complex and dynamic environments.

Types of Political Events That Impact Financial Markets

Political events have a profound impact on global financial markets, as they can influence investor confidence, market stability, and economic growth prospects. Various types of political events can trigger market reactions, often leading to volatility and significant price fluctuations across different asset classes. Here are some of the key political events that impact financial markets.

Elections:

National elections, particularly presidential or parliamentary ones, can significantly affect financial markets. The uncertainty surrounding the outcome and the potential policy changes associated with a new government can create volatility. For example, changes in leadership can lead to shifts in economic policies, fiscal plans, or regulatory approaches, which investors quickly react to. In addition, elections in major economies like the U.S. or EU member states tend to influence global market sentiment, affecting investor expectations about trade, taxation, and public spending.

Government Policies:

Policy decisions related to fiscal spending, taxation, regulation, and monetary policy can directly influence market behavior. For example, governments may introduce stimulus packages to support economic growth, or central banks might alter interest rates to combat inflation. These decisions can have immediate and long-lasting effects on various sectors, including banking, technology, energy, and healthcare.

Geopolitical Tensions and Conflicts:

Political instability, such as wars, civil unrest, or geopolitical tensions between countries, can create fear and uncertainty in financial markets. This type of volatility is often reflected in commodity prices, especially oil and gold, as investors seek safe-haven assets during periods of risk. Geopolitical events can also impact currency values, particularly if they affect trade relations or create disruption in the global supply chain.

Regulatory Changes:

Governments around the world often enact new regulations that can have a significant impact on specific sectors or industries. For example, changes in environmental laws, tax regulations, or industry-specific standards can influence the profitability of companies, affecting their stock prices. The imposition of stricter regulations on the tech, energy, or financial sectors may alter market dynamics, either increasing costs or creating new growth opportunities for businesses.

Referenda and Political Movements:

Events such as referenda (e.g., Brexit) or movements for independence (e.g., Scotland’s push for independence) can trigger financial market reactions due to the uncertainty they introduce. In these cases, markets react to the potential economic consequences of political decisions that could reshape trade relationships, regulatory frameworks, and currency stability. For example, the Brexit referendum created significant volatility in both the British pound and European markets due to concerns about the UK’s future relationship with the European Union.

How Political Events Affect Financial Markets

Political events can have a profound and multifaceted impact on financial markets, affecting everything from stock prices to currency exchange rates. The relationship between political developments and market behavior is often shaped by the level of uncertainty they introduce, the anticipated policy changes, and the broader geopolitical implications. Here are some of the key ways political events affect financial markets:

- Market Volatility:

One of the most immediate effects of political events on financial markets is increased volatility. This is especially evident during periods of uncertainty, such as elections, changes in government leadership, or geopolitical crises. When markets are unsure about the direction a country’s policies will take, or when there’s a risk of political instability, investors may react by selling off risky assets or seeking safer investments. For example, during contentious elections or political turmoil, stock prices might fluctuate rapidly as investors adjust their expectations.

- Investor Sentiment and Confidence:

Political events have a direct impact on investor sentiment, which plays a major role in market movements. If political developments suggest that economic growth will be supported or that regulations will become more favorable to business, investors may feel more confident, leading to rising stock prices. On the other hand, if the political environment suggests that economic stability is at risk—due to factors like policy uncertainty, corruption scandals, or government instability—investor confidence can drop, leading to capital flight, market sell-offs, or shifts to safer assets.

- Currency Fluctuations:

Political events often lead to shifts in currency values. Political instability or uncertainty about future government policies can cause a currency to depreciate, while strong political leadership or a stable political environment may strengthen a nation’s currency. For instance, when there is uncertainty surrounding elections or political unrest in a country, foreign investors may pull back from that country’s assets, which can lead to a depreciation of its currency.

- Sector-Specific Impacts:

Different political events can have varying effects on specific market sectors. For example, changes in government policy regarding taxation, regulation, or environmental standards can influence the profitability of companies in certain industries. Political decisions regarding infrastructure spending can benefit sectors like construction or utilities, while changes in trade policy or tariffs may benefit or hurt companies involved in international trade, such as those in the automotive, technology, or agriculture sectors.

Tips of Political Events for Financial Markets and Trading

Navigating political events effectively is a key aspect of successful trading and investing, as these events can significantly influence market conditions. Here are some valuable tips for handling political events and their impact on financial markets and trading:

1. Stay Informed and Monitor Political Developments

- Follow News and Analysis: Regularly track political news from reliable sources, including elections, government policies, geopolitical tensions, and regulatory changes. Keeping up with the latest developments helps you understand market sentiment and anticipate potential market movements.

- Use Political Risk Tools: Many financial services provide specific tools and resources for analyzing political risk, such as geopolitical risk indicators and political event calendars. Leverage these resources to identify potential risks and opportunities.

2. Understand the Specific Impact of Political Events on Markets

- Identify Key Sectors: Different political events can affect various sectors in distinct ways. For instance, a change in government could lead to policy shifts that benefit certain industries (e.g., renewable energy or infrastructure), while others may be negatively impacted (e.g., oil companies during environmental regulation changes).

- Understand Policy Implications: Political events like changes in taxation, monetary policy, or trade agreements can affect market prices. Stay up to date on the specific policies being debated or enacted to better gauge how they will influence economic growth and corporate profitability.

3. Diversify Your Portfolio

- Reduce Exposure to Political Risk: By diversifying your investments across different regions, asset classes, and industries, you can reduce your exposure to political risks tied to any single event. For example, if you are concerned about the potential impact of a trade war, diversifying into assets like gold or bonds can offer a safer alternative.

- Consider International Investments: Political events in one country can have ripple effects globally. Investing in international markets can provide a hedge against domestic political instability and can offer opportunities in economies less affected by certain political shifts.

4. Hedge Against Political Risk

- Use Derivatives: Options and futures contracts can be effective tools for hedging against political risk. For example, if you anticipate that an upcoming election could lead to significant market volatility, using options to protect against potential downside risk can be an effective strategy.

- Invest in Safe-Haven Assets: During periods of heightened political uncertainty, certain assets like gold, the U.S. dollar, and government bonds are often seen as safe havens. Allocating part of your portfolio to these assets during times of political unrest can provide stability during market downturns.

5. Be Cautious During Election Cycles

- Expect Volatility: Elections are often accompanied by uncertainty, as markets react to the potential for policy changes. Leading up to elections, there may be increased volatility as investors speculate on the outcome. In some cases, markets may stabilize once the result is known, but the election period itself can be turbulent.

- Know the Candidates’ Platforms: Understand the platforms of candidates or political parties in an election. This will give you insights into which sectors or industries are likely to benefit or be harmed depending on the election outcome. For example, a candidate advocating for stricter environmental regulations might negatively affect industries like oil and gas but positively impact clean energy sectors.

Conclusion

Political events play a critical role in shaping the dynamics of global financial markets and trading. Whether through elections, changes in government policies, geopolitical tensions, or regulatory shifts, political developments introduce uncertainty that can lead to market volatility, changes in investor sentiment, and sector-specific impacts. While short-term market reactions to political events can be dramatic, the long-term effects are often more complex, influencing investment strategies and economic growth trajectories.